If you are interested in becoming an agent in real estate, it is important to know the process and the cost of obtaining a Florida realty license. According to the school or course, the cost of a Florida realty license can range from $350 up to $700. Although there is no minimum required amount to be licensed in Florida, it is important to consider the additional fees associated with getting a license. These include the exam and MLS fees.

A person must complete the pre licensing education course before they can become licensed in Florida. It is a 63-hour course that covers several facets of the real estate industry. It includes national and state-specific topics such as insurance coverage, factors affecting the price of property, and ethical and legal practices. This course can be taken online, or in a class.

Before pursuing your Florida real estate license, you must also complete the 45-hour post-licensing education. This class is designed to teach you the skills needed to succeed in this field. It covers topics such as negotiation, dealing with objections and creating a strong selling strategy. You can take the post-license education course in a classroom, online, or by completing a self-led course.

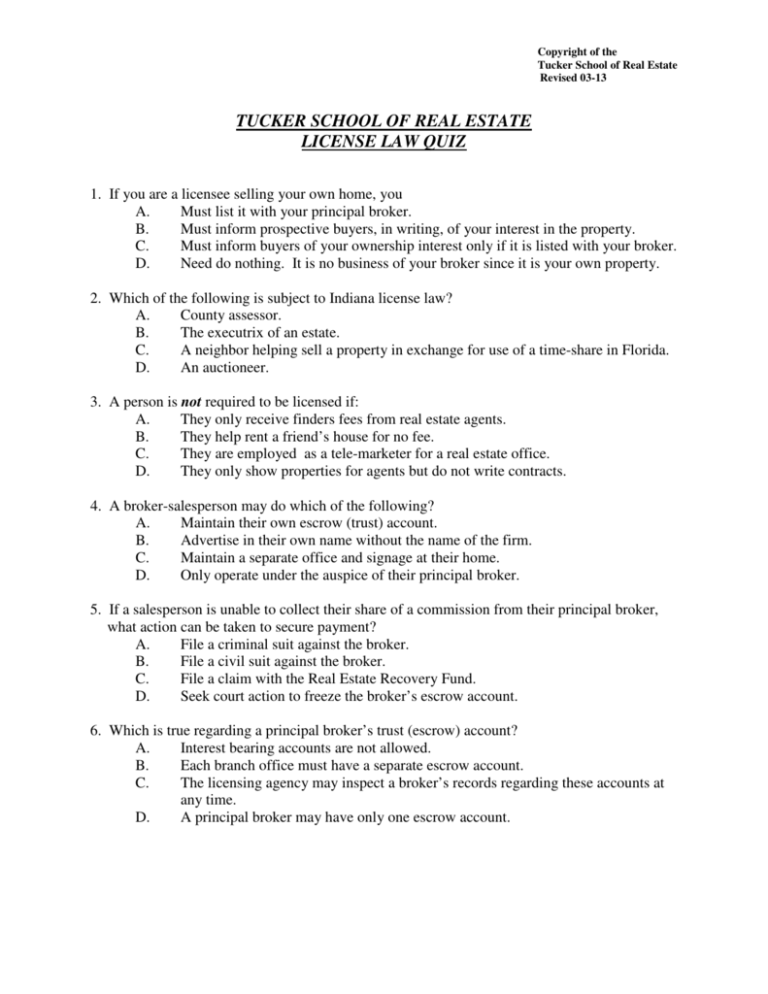

It can be hard to obtain a Florida real property license. In addition to taking pre-licensing classes and post-licensing education courses, you will also need to take the state licensing examination. The exam is composed of a 100 question multiple-choice test. This requires you to solve math calculations and Florida and Federal law questions. You must score at least 75% to pass the exam. If you fail, you can retake the exam as many times as you like within the year. You must wait at most 24 hours between each attempt before you can reschedule.

To start the process you'll need your fingerprints. A state-approved lifescan service provider will perform your fingerprinting. Each provider will charge a different fee for fingerprinting. Normally, it's $50. After you complete the background check, the Florida Department of Law Enforcement will email you to inform you that you have cleared it.

A $89 non-refundable application fee will also be required. Once your application has been submitted, you will be assigned a candidate ID number. This ID will be used for verification purposes and to certify that you are a real estate license applicant.

Pre-licensing courses are the first step to obtaining a Florida license. Exam preparation may be included or not depending on what school you choose. Test prep courses are offered by most schools. These can be helpful in preparing for the exam. Some courses can be done by yourself, while others will require the assistance of a mentor.

You'll be able complete the Florida realty license process in your home. Online courses allow you to learn on your own time, while in-person courses are ideal for a more traditional classroom setting.

FAQ

Can I buy a house in my own money?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include government-backed loans (FHA), VA loans, USDA loans, and conventional mortgages. For more information, visit our website.

How can I fix my roof

Roofs can leak due to age, wear, improper maintenance, or weather issues. For minor repairs and replacements, roofing contractors are available. Contact us for further information.

Is it better to buy or rent?

Renting is generally cheaper than buying a home. However, you should understand that rent is more affordable than buying a house. Buying a home has its advantages too. You will have greater control of your living arrangements.

What are the downsides to a fixed-rate loan?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Do I need a mortgage broker?

A mortgage broker is a good choice if you're looking for a low rate. A broker works with multiple lenders to negotiate your behalf. Brokers may receive commissions from lenders. Before signing up, you should verify all fees associated with the broker.

How long does it usually take to get your mortgage approved?

It is dependent on many factors, such as your credit score and income level. Generally speaking, it takes around 30 days to get a mortgage approved.

How much money can I get to buy my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Manage a Rent Property

Renting your home can be a great way to make extra money, but there's a lot to think about before you start. We'll show you what to consider when deciding whether to rent your home and give you tips on managing a rental property.

Here are the basics to help you start thinking about renting out a home.

-

What factors should I first consider? Before you decide if your house should be rented out, you need to examine your finances. If you are in debt, such as mortgage or credit card payments, it may be difficult to pay another person to live in your home while on vacation. Check your budget. If your monthly expenses are not covered by your rent, utilities and insurance, it is a sign that you need to reevaluate your finances. ), it might not be worth it.

-

How much is it to rent my home? It is possible to charge a higher price for renting your house if you consider many factors. These factors include location, size, condition, features, season, and so forth. You should remember that prices are subject to change depending on where they live. Therefore, you won't get the same rate for every place. Rightmove has found that the average rent price for a London one-bedroom apartment is PS1,400 per mo. This means that you could earn about PS2,800 annually if you rent your entire home. This is a good amount, but you might make significantly less if you let only a portion of your home.

-

Is it worth it? You should always take risks when doing something new. But, if it increases your income, why not try it? Be sure to fully understand what you are signing before you sign anything. Your home will be your own private sanctuary. However, renting your home means you won't have to spend as much time with your family. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Are there any benefits? It's clear that renting out your home is expensive. But, you want to look at the potential benefits. You have many options to rent your house: you can pay off debt, invest in vacations, save for rainy days, or simply relax from the hustle and bustle of your daily life. Whatever you choose, it's likely to be better than working every day. You could make renting a part-time job if you plan ahead.

-

How can I find tenants Once you've decided that you want to rent out, you'll need to advertise your property properly. You can start by listing your property online on websites such as Rightmove and Zoopla. Once you receive contact from potential tenants, it's time to set up an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

How can I make sure that I'm protected? You should make sure your home is fully insured against theft, fire, and damage. You'll need to insure your home, which you can do either through your landlord or directly with an insurer. Your landlord will often require you to add them to your policy as an additional insured. This means that they'll pay for damages to your property while you're not there. This does not apply if you are living overseas or if your landlord hasn't been registered with UK insurers. In this case, you'll need to register with an international insurer.

-

Even if your job is outside the home, you might feel you cannot afford to spend too much time looking for tenants. However, it is important that you advertise your property in the best way possible. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. You'll also need to prepare a thorough application form and provide references. Some people prefer to do the job themselves. Others prefer to hire agents that can help. You'll need to be ready to answer questions during interviews.

-

What should I do once I've found my tenant? If you have a current lease in place you'll need inform your tenant about changes, such moving dates. If this is not possible, you may negotiate the length of your stay, deposit, as well as other details. While you might get paid when the tenancy is over, utilities are still a cost that must be paid.

-

How do I collect the rent? When it comes to collecting the rent, you will need to confirm that the tenant has made their payments. You'll need remind them about their obligations if they have not. You can subtract any outstanding rent payments before sending them a final check. If you are having difficulty finding your tenant, you can always contact the police. The police won't ordinarily evict unless there's been breach of contract. If necessary, they may issue a warrant.

-

How can I avoid problems? It can be very lucrative to rent out your home, but it is important to protect yourself. Install smoke alarms, carbon monoxide detectors, and security cameras. You should also check that your neighbors' permissions allow you to leave your property unlocked at night and that you have adequate insurance. You must also make sure that strangers are not allowed to enter your house, even when they claim they're moving in the next door.