If you are thinking about buying rental property, you will need to understand what is involved. The pros and cons of renting property are important. You need to be able to see the big picture. You need to consider who will live on the property, when it will remain vacant, and why.

Rent to own

Rent to own rental property can be a great way to buy a single-family home but not have to pay the full cost. It can give you a chance to build your credit and save for a down payment before purchasing the home. It also helps you avoid private mortgage coverage.

Hard money loans

Hard money loans are loans that are based upon the property's worth, not the borrower's credit history. Lenders take into account both the current and future value of the property. Hard money lenders offer rental property loans with lower interest rates that other forms of financing.

Owner-occupancy loans

Owner-occupancy loans to buy rental properties are a great way to diversify your investment portfolio and generate rental income. Due to the risk that investors might default on the loan, these loans typically have a higher down payment and interest rate. These terms can be advantageous to real estate investors as they will be able fully to expense interest payments as a deduction from their taxes.

1031 exchanges

If you've been considering using 1031 exchanges to purchase rental property, it can be a great way to upgrade your portfolio. The key to this strategy is to find a replacement property quickly. This means that you must identify it within 45 days and close on it no later than 180 days after you sell the first property. There are several rules that must be followed, but a smart property-finder tool will make this process easier.

For rental purposes, you can buy a single-family residence.

A single-family house can offer many benefits over multifamily properties. First, single family homes offer more space both inside and outside. These homes are more attractive for tenants who have pets or families. Single-family homes often have off-street parking and fenced yards which can make them more attractive to tenants. One advantage of single family homes is that they tend to be more affordable than multi-family property.

Budgeting is essential for this entire process

Before budgeting for purchasing rental property, it is important to know how much you can afford each month. This figure should be based on your monthly income, expenses and the costs associated with owning and maintaining a rental property. Next, calculate how much will go toward monthly rent and expenses. It is crucial that you don't spend too much and that you learn how to live off your savings.

FAQ

How do I eliminate termites and other pests?

Over time, termites and other pests can take over your home. They can cause serious destruction to wooden structures like decks and furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

How long will it take to sell my house

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It may take up to 7 days, 90 days or more depending upon these factors.

Is it cheaper to rent than to buy?

Renting is generally cheaper than buying a home. However, you should understand that rent is more affordable than buying a house. A home purchase has many advantages. You will have greater control of your living arrangements.

What flood insurance do I need?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood insurance here.

Is it possible to get a second mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is used to consolidate or fund home improvements.

How do you calculate your interest rate?

Market conditions influence the market and interest rates can change daily. The average interest rates for the last week were 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

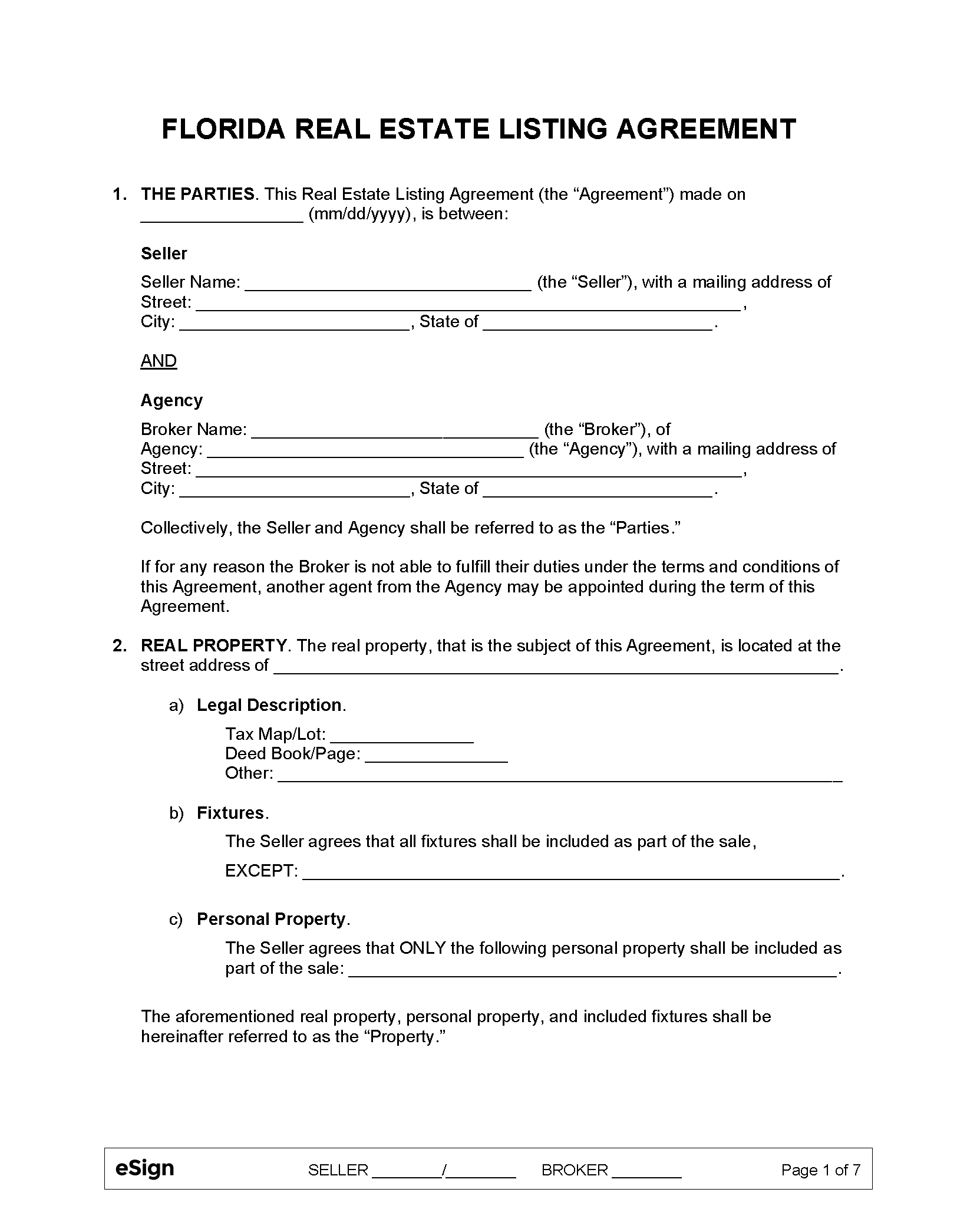

How To

How to become an agent in real estate

Attending an introductory course is the first step to becoming a real-estate agent.

Next, pass a qualifying test that will assess your knowledge of the subject. This involves studying for at least 2 hours per day over a period of 3 months.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!