A contingent sale is an agreement made by a buyer with a seller. It states that certain conditions must be met in order for the sale to proceed. A home inspection, appraisal and mortgage are all possible conditions. The buyer may consult a lawyer to assist them in drafting and executing their offer.

House Sale Contingency

The most common type of house sale contingency is a home inspection contingency. This is usually used by buyers who want to protect themselves from buying a property that has problems uncovered during the home inspection. If the home inspection shows that there are problems, the buyer can either terminate the contract or reclaim their earnest cash deposit.

Another type of house sale contingency that is common is the appraisal contingency. This contingency is used by buyers who have a mortgage and want to protect themselves from losing their earnest money if the appraisal comes in lower than the price of the home.

Buyers can also use this kind of contingency to prevent fraudulent sales or purchases. This clause states that the seller must clear any liens before closing.

Home Sale Contingency

This is a risky sale condition as the seller must accept an offer on the property. It could go through or not, depending on how long the buyer takes to sell their house. Because it poses a great risk for the seller, a lot of sellers won't accept this offer.

The seller will need to make repairs and cosmetic improvements to their home before they can list it for sale, show it off to prospective buyers, and take down any offers. If the buyer fails to get approved for a loan or their offer falls through they will be forced to accept a second offer from another potential buyer.

A contingent listing in a pending market can be a great option for sellers who want to attract a lot of buyers while their house is for sale. This is particularly helpful for homes that have been in the market for longer periods of time or during a downturn.

Contingent sales don't happen as often in seller's markets where there are a lot of homes for sale but fewer qualified buyers. In these markets, it's more common for the initial buyer to fall out of their deal before it can close.

Buyers can use a contingent sale to secure their earnest money deposit and find their dream home. It is important to remember that a contingent sale is only as strong and as confident as the buyer in their offer. Before you make an offer on any property, it is important to consider the possibility of losing your earnest money deposit.

FAQ

What is reverse mortgage?

Reverse mortgages are a way to borrow funds from your home, without having any equity. You can draw money from your home equity, while you live in the property. There are two types: government-insured and conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance covers the repayment.

How do I calculate my interest rates?

Market conditions influence the market and interest rates can change daily. The average interest rate during the last week was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

How can I find out if my house sells for a fair price?

It could be that your home has been priced incorrectly if you ask for a low asking price. A home that is priced well below its market value may not attract enough buyers. To learn more about current market conditions, you can download our free Home Value Report.

How much should I save before I buy a home?

It depends on the length of your stay. If you want to stay for at least five years, you must start saving now. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Locate Real Estate Agents

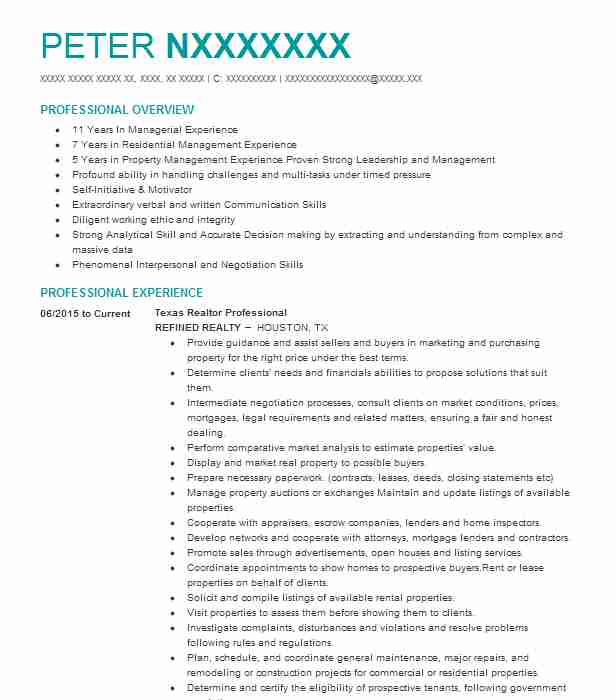

The real estate agent plays a crucial role in the market. They help people find homes, manage their properties and provide legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. It may also make sense to hire a local realtor that specializes in your particular needs.

Realtors work with homeowners and property sellers. It is the job of a realtor to help clients sell or buy their home. As well as helping clients find the perfect home, realtors can also negotiate contracts, manage inspections and coordinate closing costs. Most agents charge a commission fee based upon the sale price. Unless the transaction is completed, however some realtors may not charge any fees.

The National Association of Realtors(r), or NAR, offers several types of agents. NAR requires licensed realtors to pass a test. A course must be completed and a test taken to become certified realtors. NAR recognizes professionals as accredited realtors who have met certain standards.